Discover the Benefits of Credit Unions for Financial Success

Maximizing Your Credit Union’s Visibility: Mastering SEO Strategies In a digital age where visibility equates to viability, credit unions must embrace formidable SEO strategies to ensure their […]

Maximizing Your Credit Union’s Visibility: Mastering SEO Strategies

In a digital age where visibility equates to viability, credit unions must embrace formidable SEO strategies to ensure their services are accessible to the right audience.

Understanding the nuances of Search Engine Optimization is pivotal for institutions aiming to connect with potential members seeking financial products like checking accounts, mortgage loans, and auto loans.

By leveraging the expertise of LinkGraph and its Search Atlas SEO tool, credit unions can fine-tune their online presence, from conducting cogent keyword research to deploying a robust content strategy that engages current and prospective members.

A solid foundation in SEO not only elevates a credit union’s digital footprint but directly enhances the banking experience for its members.

Keep reading to discover how a tailored SEO approach can transform a credit union’s online presence, driving growth and member satisfaction.

Key Takeaways

- Credit Unions Must Tailor Their SEO Strategy to Meet the Specific Needs of Their Members and Improve Online Visibility

- Effective Keyword Research and Strategic Content Creation Are Essential for Engaging Potential Members and Reinforcing the Credibility of Credit Unions

- Website Optimization, Including Mobile Responsiveness and Site Speed, Is Crucial for User Experience and High Search Engine Rankings

- Utilizing Advanced Tools Like LinkGraph’s Search Atlas Can Provide in-Depth Analytics and Actionable Insights to Refine SEO Efforts

- A Comprehensive Backlink Strategy Through White Label SEO and Social Media Integration Can Significantly Enhance a Credit Union’s Digital Authority

Understanding SEO Basics for Credit Unions

For credit unions intent on expanding their reach and connecting with more members, a solid grounding in Search Engine Optimization, or SEO, proves indispensable.

This digital marketing cornerstone not only elevates a credit union’s online presence but also enhances the user experience for current and potential members seeking financial products and services.

Navigating the intricate dynamics of search engine algorithms is paramount to ensuring that a credit union’s website garners a coveted spot at the top of search results.

Initiating this journey requires a clear identification of the institution’s SEO objectives, tailored to meet the unique needs of the credit union system and its constituency, thereby setting the stage for a more impactful online strategy.

Defining SEO and Its Importance for Credit Unions

SEO, or Search Engine Optimization, serves as the linchpin for enhancing a credit union’s online footprint, directly affecting both visibility and accessibility. By optimizing their website and content for search engines, credit unions significantly increase the likelihood of appearing prominently when individuals search for financial services, such as opening a checking account or pursuing a mortgage loan.

This optimized presence is vital not only for attracting new members but also for retaining existing ones, providing a seamless banking experience that reflects the high caliber of customer service and trustworthiness associated with the credit union. In an age where digital interactions are at the forefront, the role of SEO in amplifying a credit union’s offerings cannot be understated.

How Search Engines Rank Credit Union Websites

At the core of a successful online presence, search engines utilize complex algorithms to rank websites, where factors such as relevance, user experience, and authority play critical roles. For a credit union, this means its website must contain targeted content that resonates with the financial needs and queries of its members and prospective clients, such as competitive loan rates or robust savings account options.

Critical to securing higher rankings, a credit union’s website infrastructure must ensure swift load times, mobile responsiveness, and secure transactions, adhering to rigorous security policies. These technical SEO elements are essential for search engines to consider a website trustworthy and valuable, thus positioning it favorably in the digital landscape where members seek financial guidance and services.

Identifying Your Credit Union’s Key SEO Goals

Embarking on an SEO campaign necessitates that a credit union crystallizes its goals, tailoring strategies to bolster its online prominence and meet specific benchmarks. Whether aiming to drive membership growth, promote auto loan services, or increase the visibility of high-yield savings accounts, pinpointing these targets early on sets a concrete path towards successful optimization.

Once established, these SEO goals guide the creation of a content strategy, shaping the narrative around a credit union’s strengths, such as competitive APY offerings or exemplary member support. Through this focused approach, a credit union ensures that every SEO effort, from Backlink Analysis to local SEO enhancements, pivots around these central objectives, thereby maximizing return on investment and member satisfaction.

Conducting Keyword Research to Reach Potential Members

Discerning the right keywords is pivotal for credit unions intent on enhancing their online influence; it is the gateway to connecting with individuals who seek financial assistance and services.

Mastering the tools and techniques that underpin effective keyword discovery enables these institutions to unveil terms and phrases members use when inquiring about matters such as savings accounts, mortgage loans, and auto loans online.

Analyzing the potential of these keywords for membership growth and weaving them strategically into content ensures the credit union’s narrative aligns with the needs and search behaviors of its target audience, setting the stage for heightened digital engagement and member acquisition.

Tools and Techniques for Effective Keyword Discovery

Unearthing the optimal keywords for a credit union is a crucial step in mastering SEO. Insightful keyword research relies on sophisticated tools like Search Atlas, which provides comprehensive data on search volume, competition, and relevance to the financial sector.

| Keyword Research Phase | Search Atlas Tool | Goal for Credit Union |

|---|---|---|

| Identify Keywords | Keyword Explorer | Discover relevant terms potential members are searching for. |

| Analyze Competitiveness | SEO Competition Analysis | Gauge the level of difficulty in ranking for specific keywords. |

| Evaluate Relevance | Content Gap Analysis | Ascertain gaps in current content that could be filled with targeted keywords. |

Employing these tools facilitates the creation of a robust content strategy, ensuring that credit unions resonate with their desired audience. By leveraging the analytical prowess of Search Atlas, financial institutions align their online content with the actual search behaviors of potential members, a critical component in the pursuit of enhanced digital visibility and engagement.

Analyzing Keywords for Membership Growth Potential

Analyzing keywords goes beyond just understanding search terms; it’s about recognizing the potential each keyword has in contributing to membership growth. By evaluating the intent behind the keywords, credit unions can discern how aligned a user is likely to be with the core offerings of a checking account, a high yield savings account, or a new homeowner’s mortgage loan.

Using advanced metrics to measure a keyword’s effectiveness allows credit unions to prioritize their focus on terms that promise the highest return on investment. Precision in keyword selection means credit unions position themselves to be the answer to their future members’ most pressing financial inquiries:

- Identifying high-intent keywords indicative of users ready to open accounts or apply for loans.

- Assessing keyword trends to anticipate and capitalize on seasonal needs, like home equity loans in the renovation season.

- Aligning local SEO efforts with keywords relevant to the community the credit union serves, enhancing local visibility.

Strategically Incorporating Keywords Into Your Content

The adept infusion of carefully chosen keywords into a credit union’s digital content is a nuanced process that underscores the institution’s understanding of its audience’s financial pursuits. As such, LoinkGraph’s bespoke content strategy orchestrates a symphony of keywords that unobtrusively integrates into blog posts, product descriptions, and educational resources, enriching the user journey from casual browsing to signing up for a new checking account or exploring home loan options.

LinkGraph‘s SEO services extend beyond mere keyword placement; they involve a deep comprehension of context and search intent coupled with a sophisticated application of SEO techniques. This ensures that whether an individual is contemplating a savings account or researching home equity solutions, the content they encounter is not only informative but is finely optimized to feature high on search result pages, thus amplifying the credit union’s digital footprint and member engagement.

Optimizing Your Credit Union’s Website Structure

For credit unions aiming to strengthen their market position, optimizing website structure is as crucial as any financial advisory service they offer.

A cohesive site architecture and intuitive navigation serve as the bedrock for a user’s digital journey, guiding them through various banking options with ease.

Aspects such as mobile optimization not only direct traffic but also favorably influence search rankings, reflecting the growing trend of on-the-go banking.

Similarly, a concerted effort to boost website speed enhances overall user experience, which search engines acknowledge and reward with superior visibility.

An impeccable website structure is therefore not an accessory but a fundamental component in the blueprint of a credit union’s SEO strategy.

Best Practices for Site Architecture and Navigation

Meticulous attention to site architecture is imperative for credit unions, reinforcing the ease with which visitors locate information and navigate services. By structuring their website so that information on products such as loan rates, checking accounts, or credit union credit facilities flows logically, credit unions cater to user convenience, thereby improving engagement and the propensity to convert casual browsers into committed members.

Navigation clarity is another cornerstone of site optimization, with LinkGraph’s One-Page SEO Services focusing on streamlining user pathways to facilitate swift and secure access to banking experience essentials. This strategic approach ensures members can move seamlessly from learning about a savings account’s annual percentage yield (APY) to actually opening an account, solidifying the credit union as a locus of excellent customer service and efficiency.

Mobile Optimization to Improve Search Rankings

In the pursuit of bolstering search rankings, credit unions must prioritize mobile optimization, considering the increasing predominance of smartphone banking. LinkGraph’s comprehensive SEO Audit includes rigorous mobile responsiveness testing, ensuring that each credit union’s website delivers an optimal experience on all devices, which is vital for maintaining strong search engine positioning.

Modern consumers expect instantaneous access to banking services, from checking balances to applying for home equity loans, directly from their mobile devices. Recognizing this shift, LinkGraph’s SEO services meticulously refine every website element, from navigation to load times, to align with the mobile-first indexing practices of leading search engines, thus securing higher visibility for credit unions in the digital realm.

Enhancing Website Speed for Better User Experience

When it comes to advancing the customer service experience, a credit union’s website speed emerges as a non-negotiable attribute. Members expect rapid access to their accounts, whether it’s for reviewing auto loan details or setting up a mobile banking app, and a sluggish site can deter even the most loyal users.

Consequently, LinkGraph’s dedication to accelerating website performance translates into tangible benefits for credit unions and their members. Enhanced site speed translates into more efficient customer service and reinforces trust, as members consistently receive the swift, reliable access they associate with their banking needs:

| Website Function | Impact of Speed Optimization | Member Benefit |

|---|---|---|

| Account Access | Quicker Login and Transaction Times | Enhanced Banking Experience |

| Information Retrieval | Reduced Page Load Delays | Immediate Access to Financial Data |

| Loan Application Processing | Streamlined Submission and Feedback | Faster Loan Approval and Funding |

LinkGraph implements advanced caching strategies, optimizes images, and streamlines code to ensure that every interaction on the credit union’s website is met with prompt responses. Consequently, this meticulous optimization process is emblematic of the credit union’s commitment to top-tier digital services, fostering an environment where members can manage their finances with unparalleled ease and confidence.

Creating Valuable Content That Resonates With Members

In a quest to solidify rapport with both prospects and existing members, credit unions are turning to content creation as a means to share their knowledge and elucidate the maze of personal finance.

Far from a perfunctory exercise, this deliberate content production embodies strategies tailored to captivate and inform.

Blog posts rich with financial tips, a commitment to financial literacy through educational material, and the integration of video content coalesce to form a multifaceted approach towards improved engagement.

Each element is meticulously crafted to not merely occupy space on a webpage, but to resonate deeply with the individuals that credit unions serve, fostering trust and reinforcing their position as more than a financial institution, but as a partner in financial well-being.

Blogging About Financial Tips to Engage Users

Blogging stands as a quintessential pillar in the construct of content marketing, particularly for credit unions seeking to engage with their community. LinkGraph understands the fine art of crafting blog posts that not only disseminate financial tips but also integrate critical keywords which drive SEO success.

LinkGraph’s Blog Writing services marry the intricacies of financial education with the compelling narratives that resonate with an audience seeking fiscal guidance. These posts become instrumental in fostering relationships, converting casual readers into committed credit union members who value the insights availed by their trusted financial partner.

Leveraging Financial Education as Content Strategy

Leveraging financial education as part of a content strategy enables credit unions to connect with their members on a deeper level, establishing themselves as invaluable resources for financial wisdom. By providing educational content that demystifies complex financial concepts, such as explaining the benefits of different account types or the specifics of loan repayment, credit unions empower their members to make informed decisions with confidence.

This conscientious approach to content not only exemplifies the core values of the credit union system but also serves to enhance its SEO ranking, as informative, educational materials attract more traffic and encourage engagement. Credit unions that invest in financial education-centric content distinguish themselves as thought leaders, nurturing trust and loyalty among current and prospective members:

- Offering insights into the national credit union administration (NCUA) insurance to instill confidence in the security of members’ deposits.

- Guiding first-time home buyers through the mortgage loan process, supporting them on the path to homeownership.

- Providing comparative analysis of investment vehicles, helping members to strategize effectively for their retirement.

Video Content as a Tool for Improved Engagement

In today’s digitized landscape, credit unions gain significant traction by integrating video content into their outreach strategies. A dynamic video serves as both a visual and auditory stimulus, engaging members more profoundly than text alone could achieve, thus driving home the message of financial stability and service offerings effectively.

LinkGraph utilizes the power of video to distill complex financial topics into digestible content that captivates and educates. By presenting information on home equity loans or the intricacies of mobile banking through a medium favored by consumers, credit unions are not just sharing information—they’re providing an immersive experience that enhances understanding and member confidence.

Building Authority With a Solid Link Building Strategy

To enhance a credit union’s prominence and trustworthiness in the digital space, it is essential to construct a comprehensive link building strategy.

It’s not just about being visible; it’s about being recognized as an authority by both search engines and users.

LinkGraph’s White Label Link Building services assist credit unions in identifying and securing quality backlinks that signal to search engines the inherent value and credibility of their financial content.

Furthermore, through astute social media integration, credit unions can achieve broader reach and garner links that amplify their visibility, fostering a greater sense of community online.

Strategic partnerships with local organizations can also result in valuable backlinks, strengthening the credit union’s roots within the community it serves.

Identifying and Pursuing Quality Backlink Opportunities

In boosting a credit union’s authority online, the caliber of backlink sources is imperative. Aligning with reputable sites through LinkGraph’s White Label SEO, credit unions witness an upsurge in domain authority, which is pivotal for climbing the ranks in search engine results. LinkGraph’s meticulous Backlink Analysis methodically sifts through potential link opportunities to pinpoint those with the greatest potential to bolster the credit union’s online credibility.

Strategically seeking out these backlink opportunities, credit unions engage in a form of digital networking that extends their reach beyond immediate members. Pursuing Guest Posting on finance-focused platforms, LinkGraph navigates the intricate web of online relationships, securing guest posts and linking arrangements that underpin a credit union’s reputation as a trustworthy financial institution committed to exceptional service.

Social Media Integration for Broader Reach and Links

Social media stands as a crucial conduit for credit unions to enhance their online presence and augment their backlink portfolio. By leveraging social platforms, these institutions tap into a verdant source of potential backlinks that elevate their SEO stature and digital authority.

The adept integration of social media in a credit union’s link building strategy fosters not just visibility but genuine engagement. Through strategic content sharing and collaboration with influencers within the financial sector, LinkGraph facilitates the forging of connections that translate into high-quality backlinks.

| Link Building Aspect | Social Media Platform | Advantage for Credit Union |

|---|---|---|

| Content Sharing | LinkedIn, Twitter, Facebook | Expands Reach and Attracts Potential Backlinks |

| Influencer Collaboration | Instagram, YouTube | Enhances Credibility and Link Acquisition |

| Member Engagement | Facebook Groups, Twitter Threads | Builds Community and Encourages Organic Links |

Collaborating With Local Organizations for Backlinks

Forging partnerships with local organizations presents a formidable tactic for credit unions to secure valuable backlinks, amplifying their SEO initiatives. Establishing these collaborative relationships, LinkGraph propels credit unions to new heights of digital visibility, ingraining them within the fabric of the community they serve.

Through intelligent outreach and community engagement, credit unions gain backlinks from local enterprise websites, event announcements, and community resource listings. These associations, forged by LinkGraph’s White Label Link Building services, not only strengthen the financial institution’s local presence but also enhance its overall digital authority.

Tracking Your SEO Progress and Adjusting Tactics

As credit unions aim to sharpen their competitive edge in the digital finance arena, steadfast monitoring and evolution of their SEO strategies become critical.

It’s not just about launching a campaign; it’s about the ongoing optimization that ensures sustained visibility and relevance in an ever-changing online landscape.

Credit unions, therefore, invest in scrutinizing key SEO metrics that offer insights into performance, deploying analytics to refine and adapt their digital tactics continuously, and vigilantly keeping abreast of SEO trends that could impact their visibility and member engagement.

Essential SEO Metrics for Credit Unions to Monitor

To gauge the success of an SEO strategy, credit unions must vigilantly track a variety of metrics. These data points serve as indicators of a website’s health, visibility in search rankings, and the effectiveness of content in engaging an audience.

- Website traffic trends can demonstrate the reach of a credit union’s digital presence.

- Ranking for target keywords indicates visibility to potential members seeking financial services.

- Conversion rates reflect the effectiveness of a website in turning visitors into engaged members or borrowers.

Moreover, credit unions analyze the quality and quantity of backlinks as part of their SEO metrics, understanding that a strong backlink profile signals authority and trust to search engines. Constant review of these performance metrics ensures credit unions can pivot and refine their strategies to meet the dynamic standards of search engines and user expectations.

Using Analytics to Refine SEO Strategies Over Time

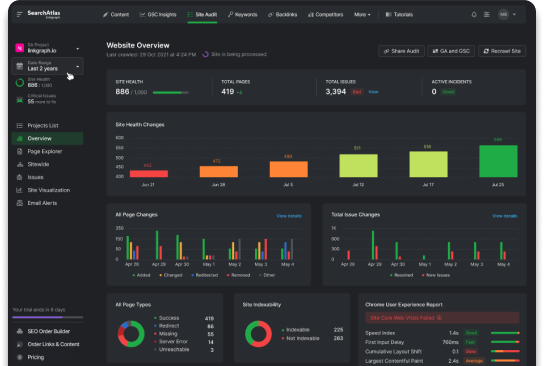

Deploying sophisticated analytics is central to the continual refinement of a credit union’s SEO strategy. LinkGraph’s Search Atlas tool empowers credit unions to dive into comprehensive data, translating complex analytics into actionable insights that drive SEO enhancements.

| SEO Metric | Tool Utilized | Actionable Insight |

|---|---|---|

| Page Performance | Site Audit Feature | Identify and rectify technical issues affecting user experience. |

| Backlink Profile | Backlink Analysis | Assess link quality and develop strategies for acquisition of authoritative links. |

| Content Engagement | Content Strategy Review | Optimize articles and blog posts to increase member interaction and dwell time. |

Periodically, it becomes essential to pivot SEO tactics, ensuring that the strategies adopted correlate with technological evolution and market trends. By scrutinizing SEO analytics through LinkGraph’s Search Atlas, credit unions remain agile, capable of not just adapting to the ebb and flow of online dynamics but leveraging them to cement their authority and maintain engagement with their audience.

Staying Updated With SEO Trends Affecting Credit Unions

For credit unions, staying ahead in the SEO domain means remaining in lockstep with the latest trends and algorithmic changes that search platforms roll out. It is critical for these institutions to adapt their digital marketing strategies swiftly, ensuring that their online content meets the evolving criteria that dictate search rankings.

Proactive engagement with SEO communities and ongoing education for their marketing teams enable credit unions to implement timely updates to their SEO practices. This attentiveness to the digital pulse safeguards a credit union’s online relevance, positioning it as a contemporary and trustworthy entity in the financial sector:

- Engagement with SEO thought leaders and communities brings fresh perspectives on emerging trends.

- Scheduled training for marketing staff ensures best practices are applied consistently across the institution’s digital portfolio.

- Regular review of industry case studies and search engine guidelines supports strategic adaptability.

Frequently Asked Questions

How can credit unions effectively utilize SEO strategies to increase visibility and attract potential members?

Credit unions can successfully boost their visibility and attract prospective members by leveraging SEO strategies that address the specific needs and search behaviors of their target audience. Such strategies may include optimizing their website content for financial terms, creating valuable articles on topics like home equity loans or savings account benefits, and ensuring their local branches rank highly in local search results.

What are the key steps in conducting thorough keyword research for credit unions?

Conducting thorough keyword research for credit unions involves identifying relevant terms that potential members use when seeking financial products and services. It’s essential to analyze these keywords for search volume and competition, ensuring they align with the credit union’s content strategy to drive targeted traffic to its website.

How can credit unions optimize their website structure to improve search engine rankings?

Credit unions can enhance their website’s architecture for better search engine visibility by implementing a robust SEO strategy, focusing on an organized sitemap that enables search engines to index content efficiently. Furthermore, emphasizing high-quality, relevant content infused with strategically placed keywords can improve a website’s ranking, making it vital for these financial institutions to collaborate with SEO experts like those at LinkGraph who specialize in SEO audits, Local SEO, and bespoke Content Strategy development.

What are the best practices for creating valuable content that resonates with credit union members?

The best practices for producing content that connects with credit union members involve understanding their unique financial needs and crafting tailored information that supports their goals, from saving strategies to loan advice. It’s essential that content is both informative and engaging, demonstrating the value and expertise that the credit union brings to the individual member, whether it’s through tips on achieving financial health or insights into the benefits of products like rewards credit cards and home equity loans.

How can credit unions build authority and credibility through a solid link building strategy?

Credit unions can establish authority and credibility in the financial arena by implementing an astute link-building strategy that boosts their online presence and search engine rankings. By leveraging professional SEO services, such as those offered by LinkGraph, credit unions can enhance their digital footprint, drawing on techniques from backlink analysis to white label link building, all tailored to propel a credit union’s relevance and trustworthiness.

What role does mobile optimization play in a credit union’s SEO strategy, and why is it crucial for improving search rankings?

Mobile optimization is a fundamental aspect of a credit union’s SEO strategy, catering to the increasing prevalence of smartphone usage in banking. This practice not only directs traffic effectively but also positively influences search rankings. LinkGraph’s SEO Audit includes rigorous mobile responsiveness testing, ensuring optimal user experiences across all devices. Recognizing the shift toward mobile-first indexing by search engines, LinkGraph’s SEO services meticulously refine website elements to secure higher visibility for credit unions in the digital realm.

How can credit unions leverage video content to enhance engagement and communicate effectively with their members?

In today’s digital landscape, credit unions can gain substantial traction by integrating video content into their outreach strategies. Video content serves as both a visual and auditory stimulus, engaging members more profoundly than text alone. LinkGraph utilizes the power of video to distill complex financial topics into digestible content, providing an immersive experience that enhances understanding and member confidence. By presenting information through a medium favored by consumers, credit unions can effectively communicate messages of financial stability and service offerings.

What are the key metrics that credit unions should monitor to assess the success of their SEO strategy, and how do these metrics contribute to their online visibility?

To gauge the success of an SEO strategy, credit unions must vigilantly track various metrics that serve as indicators of a website’s health, visibility, and content effectiveness. These metrics include website traffic trends, ranking for target keywords, conversion rates, and the quality and quantity of backlinks. Monitoring these metrics provides insights into performance, helping credit unions refine their strategies to meet evolving search engine standards and user expectations. LinkGraph’s Search Atlas tool empowers credit unions to delve into comprehensive data, translating complex analytics into actionable insights for continuous SEO enhancement.

How does the integration of social media contribute to a credit union’s link-building strategy, and what advantages does it offer in terms of SEO?

Social media integration plays a crucial role in enhancing a credit union’s online presence and augmenting its backlink portfolio. Leveraging social platforms allows credit unions to tap into a potential source of backlinks that elevates their SEO stature and digital authority. LinkGraph facilitates the forging of connections through strategic content sharing and collaboration with influencers within the financial sector. The adept integration of social media not only expands reach and attracts potential backlinks but also fosters genuine engagement, contributing to the credit union’s overall visibility and credibility in the digital space.

How can credit unions adapt their SEO strategies over time by staying updated with the latest trends, and what steps can they take to remain contemporary and trustworthy in the financial sector?

For credit unions to remain competitive in the digital finance arena, staying updated with the latest SEO trends and algorithmic changes is imperative. Proactive engagement with SEO communities, ongoing education for marketing teams, and regular review of industry case studies and search engine guidelines enable credit unions to implement timely updates to their SEO practices. This attentiveness safeguards a credit union’s online relevance, positioning it as a contemporary and trustworthy entity in the financial sector. By staying informed and adapting to evolving criteria, credit unions can solidify their authority and maintain engagement with their audience in the ever-changing online landscape.

Conclusion

Maximizing visibility through expert SEO strategies is crucial for credit unions seeking growth and engagement in the digital arena.

By understanding the mechanics of search engine algorithms and implementing a tailored SEO approach, credit unions enhance their online presence, reaching potential and existing members more effectively.

Focusing on keyword optimization, a strategic website structure, and creating valuable content aligns with user needs, bolstering the institution’s prominence and trust.

Additionally, a comprehensive link building strategy and continuous tracking of SEO progress ensure that credit unions adapt to changes and maintain their competitive edge.

Through diligent application of SEO best practices, credit unions can secure a top position in search results, translating into increased membership and stronger financial communities.