Elevate Your Online Presence: SEO Tips for Loan Officers

Mastering SEO: Advanced Strategies for Loan Officers to Dominate Online Search Results In the competitive landscape of mortgage lending, loan officers must hone their online presence to […]

Mastering SEO: Advanced Strategies for Loan Officers to Dominate Online Search Results

In the competitive landscape of mortgage lending, loan officers must hone their online presence to outrank competitors and capture the attention of savvy homebuyers.

Mastering Search Engine Optimization (SEO) becomes paramount as it dictates how visible your services become in a crowded digital market.

This article unfolds advanced SEO strategies tailored for loan officers aiming to elevate their search engine rankings and secure more mortgage leads.

With a focus on enhancing site authority, pinpointing high-intent keywords, and deploying targeted content strategies, loan officers can connect with potential clients more effectively.

Keep reading to discover how LinkGraph‘s comprehensive SEO services can transform your online visibility into unparalleled market dominance.

Key Takeaways

- LinkGraph’s SEO Services Provide a Strategic Advantage for Loan Officers in the Mortgage Industry Through Comprehensive Backlink Analysis and Content Strategy

- Effective SEO Strategies for Loan Officers Include Optimizing Google My Business Profiles, Using Local Keywords, and Leveraging Social Media to Increase Online Visibility and Search Rankings

- Incorporating Responsive Web Design and Optimizing for Mobile Search Are Essential for Loan Officers to Improve User Experience and Adapt to the Increasing Prevalence of Mobile Device Use

- Strategic Use of Structured Data and Regular SEO Audits Can Significantly Elevate a Loan Officer’s Search Result Visibility and Website Performance

- Securing Websites With HTTPS Is Pivotal for Building Trust With Consumers and Search Engines, Contributing to Improved Search Engine Rankings for Loan Officers

Enhancing Your Site’s Authority With Quality Backlinks

In the fiercely competitive landscape of the mortgage industry, loan officers seeking to distinguish their online presence must focus on refining one essential aspect of their search engine optimization: backlink strategy.

Employing LinkGraph’s refined SEO services, financial professionals can secure a formidable advantage by garnering high-quality backlinks from high-authority domains within the financial sector.

Constructing sophisticated, content-driven campaigns initiates a magnetism for inbound links while the pursuit of mutually beneficial relationships with key finance influencers and venerated industry websites can yield significant reciprocal linking opportunities.

Furthermore, strategic alliances within the finance community can broaden the scope for link sharing.

Regular Backlink Analysis is vital to safeguard against deleterious links that could undermine a site’s credibility.

All these strategies converge to enhance a site’s stature and its capacity to ascend to the pinnacle of search engine rankings, an ambition within arm’s reach with LinkGraph’s comprehensive suite of SEO tools and services.

Identify High-Authority Domains in the Financial Sector

Loan officers aiming to maximize their online visibility must prioritize the identification of high-authority domains within the financial sector. By focusing on domains that are recognized as thought leaders and trusted information sources, mortgage professionals can bolster the profile of their website, enhancing the credibility and search rank of their offerings.

Effective discernment in this area leverages LinkGraph’s Search Atlas tool, which simplifies the process of discovering these high-authority platforms. Once identified, loan officers can tailor their Content Strategy to align with the interests and needs of these top-tier sites:

- Conduct thorough backlink analysis to measure the authority of potential linking domains.

- Develop compelling Guest Posting and Blog Writing initiatives designed for quality publication matches.

- Engage in White Label Link Building that accentuates relevancy and value for both parties.

Craft Compelling Content That Attracts Inbound Links

LinkGraph’s comprehensive grasp of search engine optimization steers mortgage professionals towards the creation of content that not only informs but entices. By pinpointing the pain points and aspirations of potential clients, from first-time homebuyers to seasoned investors, loan officers can craft narratives that resonate deeply, thereby naturally attracting inbound links from reputable sources.

The fusion of SEO expertise and a keen understanding of consumer behavior impels the development of resources that stand out in a saturated market. With the support of LinkGraph’s SEO Audit and On-Page SEO Services, loan officers can ensure that every article, guide, and market analysis they produce not only speaks to their audience but also carries the technical hallmarks that search engines and linking domains value.

Engage With Influential Finance Bloggers and Websites

Loan officers can elevate their SEO strategy by fostering relationships with finance bloggers and influential websites. Establishing connections with these digital thought leaders enables the promotion of content through guest blogging and collaborative efforts, solidifying the standing of their website in search results and drawing the attention of potential mortgage applicants.

Partnerships with respected finance platforms amplify reach and reinforce the credibility of the loan officer’s content among consumers. LinkGraph’s suite of SEO services, including expert content strategy and White Label SEO solutions, provides the framework necessary for loan officers to engage effectively with these prominent figures in the financial community, thereby bolstering their SEO efforts.

Leverage Industry Partnerships for Link Sharing

Loan officers keen on extending their reach in the digital realm recognize the potent dynamic afforded by industry partnerships to enhance link sharing. Collaboration with professional associations, local business coalitions, and educational institutions in the mortgage landscape establishes a foundation for reciprocal backlink exchanges that fortify site rank and extend domain authority.

Through strategic partnerships, LinkGraph’s SEO services meticulously cultivate a network that not only enhances visibility but also solidifies the reputation of a loan officer’s site. This approach underscores the site’s relevance within the niche of mortgage lending, projecting a level of expertise and trustworthiness that compels search engines to take notice.

Monitor Your Backlink Profile for Toxic Links

Within the realm of search engine optimization, vigilance is key, particularly when monitoring one’s backlink profile. LinkGraph’s meticulous backlink analysis service enables loan officers to detect and address toxic links that could potentially damage their site’s integrity and search rank standing.

Recognizing the threat that poor-quality links pose, LinkGraph empowers its clients with the tools needed to maintain a pristine backlink portfolio. This proactive stance ensures that a loan officer’s site remains authoritative and trusted by search engines, effectively safeguarding the digital reputation of their mortgage offerings.

Leveraging Advanced Keyword Research for Loan Officers

In the arena of mortgage lending, the acumen to navigate search engine algorithms significantly dictates the online success of loan officers.

Masterful keyword research is the linchpin of a robust SEO strategy, proffering the precision needed to hone in on the specific search terms and phrases that prospective mortgage applicants enter into search engines.

By meticulously analyzing competitive landscapes for untapped keyword opportunities, strategically deploying long-tail keywords to capture niche markets, tapping into local search dynamics, and aligning content with user intent, loan officers can elevate their web presence and outshine competitors in search results.

LinkGraph’s SEO services harness these practices, ensuring that loan officers wield the insights needed to secure their place at the forefront of online search visibility.

Analyze Competitors to Uncover Keyword Opportunities

In the voyage of optimizing search engine presence, loan officers must deftly embark on competitor analysis as part of their SEO strategy. LinkGraph endows mortgage professionals with the tools to dissect competitors’ keyword usage, unveiling gaps and opportunities to surpass their online reach.

Through such strategic examination, LinkGraph aids loan officers in refining their target keywords, helping to illuminate the path toward top search engine placements that are integral to attracting mortgage leads and harnessing the attention of prospective borrowers.

Utilize Long-Tail Keywords for Niche Targeting

For loan officers, the inclusion of long-tail keywords in their SEO blueprint presents a calculated approach to niche targeting. By harnessing specific and often less competitive phrases used by homebuyers and borrowers, they signal relevance and expertise to search engines, thus elevating their mortgage website among discerning searchers.

LinkGraph equips clients with the SEO prowess to expertly integrate these descriptive keywords into a judicious content strategy. This sharpens the focus of their digital assets, connecting with a highly targeted audience that exhibits a stronger intent to engage in mortgage services, and positions loan officers as the answer to their specific home loan inquiries.

Explore Local Keyword Variations for Geotargeting

Local keyword variations play a pivotal role in helping loan officers navigate the ever-evolving terrain of digital marketing. Loan officers can reach targeted local markets by incorporating geographically-specific terms related to their services, like “mortgage broker in [City Name]” or “home loans [Area]” into their SEO strategy.

This geotargeting tactic, refined through LinkGraph’s Search Atlas tool, allows for the crafting of content that resonates with a local audience, ensuring that those in search of localized mortgage solutions are met with relevant and engaging options. Loan officers become the go-to source for mortgage inquiries within their community, facilitating a stronger connection with local searchers:

| SEO Focus | Local Variations Used | Resultant Benefit |

|---|---|---|

| Mortgage Keywords | “best mortgage rates in [City Name]” | Targets users searching for competitive rates within a specific locale |

| Loan Assistance | “home loan help [Area]” | Attracts homebuyers seeking guidance in the local area |

| Refinancing Options | “refinance home [Neighborhood]” | Captures audience interested in refinancing options in a niche market |

Refine Keyword Strategy With Search Intent Analysis

Within the digital habitat of the mortgage sector, LinkGraph nurtures loan officers’ SEO strategies with a savvy emphasis on search intent analysis. Understanding the motivations behind search queries allows for the refinement of keyword strategies, ensuring content aligns seamlessly with what mortgage seekers are actively pursuing.

- Dissect customer inquiries to determine underlying search intent.

- Align content development with verified patterns in user behavior.

- Optimize landing pages to match the expectations of organic traffic.

LinkGraph, recognized for its exquisite grip over SEO landscapes, guides loan officers in transcending simple keyword insertion. By astutely aligning their SEO efforts with user intent, loan officers can structure content that resonates precisely with the user’s journey – from initial search to the final selection of a mortgage lender.

Optimizing Loan Officer Listings for Local SEO Success

The digital landscape serves as a battleground where loan officers vie to claim the attention of prospective clients.

In the quest to dominate online search results, a multifaceted approach to Local SEO offers leverage crucial for mortgage experts to excel over their peers.

Mastery in local search optimization lies in a few fundamental tactics: from maximizing visibility through Google My Business profiles to cultivating a wealth of client testimonials that bolster local prominence.

Embedding pertinent local keywords into web content further crystallizes the relevance of services offered.

Together, these strategies form a cohesive blueprint that can elevate the professional stature of loan officers in the online arena, positioning them as the premier choice for potential homebuyers and mortgage applicants in their respective localities.

Claim and Optimize Your Google My Business Profile

For loan officers, one of the most critical steps toward local SEO dominance is claiming and meticulously optimizing their Google My Business (GMB) profile. This profile acts as a digital storefront, offering crucial information at a glance to potential local clients.

Optimization involves more than mere presence; it requires attentiveness to detail such as ensuring accuracy in contact information, operating hours, and a succinct yet compelling description of mortgage services offered:

- Thoroughly populate all relevant sections of the GMB profile with up-to-date and precise details.

- Incorporate high-quality images that reflect the professionalism of the services provided.

- Regularly gather and respond to customer reviews to demonstrate active engagement and credibility.

These proactive steps pave the way for increased visibility and trustworthiness, key tenets in a successful local SEO strategy that can propel loan officers to the top of local search results.

Build Citations in Finance-Specific Directories

Enlisting loan officers in finance-specific directories is a vital maneuver that fortifies online authority. LinkGraph deftly navigates this terrain, placing client profiles in directories that resonate with the target market, enhancing visibility among those seeking specialized lending services.

Carefully curated citations within these niche directories not only amplify a loan officer’s reach but also imbue their service offerings with sector-specific authority. LinkGraph engineers this strategic placement to bolster relevance in the eyes of both search engines and prospective borrowers alike.

Encourage Client Reviews for Boosting Local Signals

In the pursuit of optimizing local SEO, loan officers must recognize the persuasive power of client reviews. These testimonials serve as robust signals to search algorithms, heralding the trustworthiness and quality of service provided by mortgage experts.

Active solicitation and management of client feedback can significantly amplify a loan officer’s local search presence. It demonstrates to search engines a continuous stream of verification from the community they serve, reinforcing local relevance and expertise.

| SEO Element | Client Review Action | Local SEO Impact |

|---|---|---|

| Authentic Testimonials | Encourage satisfied customers to share their experiences | Heightens credibility and fosters trust among local searchers |

| Review Volume | Maintain regular influx of fresh, genuine reviews | Signals active customer interaction and service validation to search engines |

| Response Strategy | Engage with all reviews, addressing concerns and showing appreciation | Exhibits exceptional customer service, further encouraging positive local signals |

Target Local SEO Keywords in Your Website Content

Incorporating local SEO keywords into website content is a powerful tactic that loan officers use to connect with their community. This method involves placing geographically relevant terms strategically throughout web pages, from the homepage to individual listings, thus enhancing the relevance for local borrowers and increasing the likelihood of appearing in localized search results.

With the precision of LinkGraph’s SEO services, loan officers can seamlessly weave location-based keywords into informative and engaging content. This integration skillfully resonates with the search habits of prospective homebuyers, leading to a more vibrant online presence within the target area and an improved rate of visitor to client conversion.

Crafting a Content Marketing Strategy That Drives SEO

In a sector as nuanced as mortgage lending, loan officers operate under the imperative to establish and fortify their online authority.

To achieve preeminence in a dense digital ecosystem, developing a robust content marketing strategy emerges as a cornerstone of search engine optimization.

This approach includes creating rich, educational guides on diverse loan products, perpetually refreshing a blog with the latest market insights, exploring the impact of visual content on user engagement, and harnessing the reach of social media platforms.

These tactics, when synchronized, can not only illuminate the path to superior search engine standings but also construct a brand that resonates trust and expertise among both current and prospective clients.

Develop Comprehensive Guides on Loan Products

In an industry where clarity is king, loan officers can achieve greater SEO success by crafting comprehensive guides that articulate the intricacies of various loan products. Such in-depth resources serve to establish the loan officer’s website as a fountainhead of knowledge, leading to increased dwell time and user engagement which are key signals for search engine algorithms.

LinkGraph’s SEO services empower loan officers to distill complex mortgage information into compelling, accessible content, thereby becoming beacons for both search engines and potential homebuyers. By elucidating topics such as interest rates, loan terms, and application processes, loan officers can enhance their site’s authority and improve its performance in search results.

Regularly Update a Blog With Industry Insights

For loan officers, maintaining a blog replete with the latest industry insights stands as a beacon, attracting visitors and signaling expertise to search engines. A blog that frequently showcases market trends, legislative changes, and financial advice underscores a commitment to staying at the industry’s forefront.

An insightful blog proffers dual advantages: it engages a loan officer’s target audience with relevant, timely content and concurrently delights search engines with a steady cadence of fresh material. Content that conveys authority and provides utility ensures a site’s prominence in a landscape crowded with competing voices:

| Content Type | Benefits to Audience | SEO Advantages |

|---|---|---|

| Market Trends | Keeps readers informed on the latest shifts in the mortgage landscape. | Adds topical relevance, increasing visibility in search result trends. |

| Legislative Updates | Advises borrowers on regulatory changes that may affect their loans. | Targets keywords related to new regulations, attracting niche traffic. |

| Financial Tips | Empowers clients to make more informed borrowing decisions. | Boosts engagement metrics, which factors into search rankings. |

Create Visual Content to Enhance User Engagement

In today’s digital landscape, loan officers tap into the power of visual content to hook their audience and magnify engagement. Recognizing that compelling imagery and infographics can make complex financial concepts more digestible, they incorporate such elements to captivate prospective clients and heighten retention.

Loan officers deploying visuals as part of their SEO strategy observe a notable uptick in user interaction, with website visitors more likely to share and engage with content that contains relevant and appealing graphical information:

| Visual Content Type | Engagement Influence | SEO Benefit |

|---|---|---|

| Infographics | Breaks down complex loan data into understandable chunks. | Increases time on page and likelihood of social sharing. |

| Interactive Calculators | Provides value by personalizing data for the user’s scenario. | Enhances user experience, signaling quality to search engines. |

| Video Tutorials | Guides users through loan processes step-by-step. | Boosts dwell time and provides rich content for indexing. |

Distribute Content Through Social Media Channels

In an era where digital connectivity is paramount, loan officers leverage social media platforms to disseminate their carefully curated content. By strategically sharing blog posts, infographics, and insightful commentary across networks like LinkedIn, Twitter, and Facebook, they enhance visibility and foster meaningful interactions with their audience.

LinkGraph’s astute understanding of digital marketing dynamics guides loan officers to target the right social channels that resonate with their clientele. This targeted approach ensures content reaches those most likely to engage with mortgage services, effectively broadening the professional impact of loan officers online.

Utilizing Social Media Platforms to Amplify SEO Efforts

In the era of ubiquitous digital connections, loan officers are increasingly recognizing the power of social media as a pivotal extension of their SEO strategy.

Navigate through this multifaceted landscape, these financial experts are employing dynamic methods to share valuable content that redirects traffic to their primary digital real estate—their website.

This initiative not only serves to enhance the visibility of their brand but also cultivates an engaged community that reinforces their online authority.

As loan officers interweave their social media activities with their comprehensive SEO strategy, they maintain vigilance over engagement metrics, allowing for the constant refinement of their tactics to stay at the forefront of the ever-changing digital sphere.

Share Valuable Content to Drive Traffic to Your Website

Loan officers harness the potential of social media to channel substantial traffic to their websites by sharing content that possesses true value to their audience. The strategic dissemination of insightful articles, pivotal market analyses, and breakthrough industry news engages users, prompting them to seek more information and, consequently, visit the loan officer’s website for in-depth knowledge.

Critical to this strategy is crafting content that stands out in the vast social media landscape for its authenticity and utility: day-to-day advice for saving towards a down payment, interpreting fluctuating interest rates, or navigating the mortgage application process. By prioritizing content that addresses real-world concerns, loan officers become trusted resources:

- Educational posts that guide first-time homebuyers.

- Market updates that capture the interest of potential investors.

- Personalized stories that illustrate successful loan management.

This approach not only directs followers to the loan officer’s site but also establishes a reputation for thought leadership, fostering long-term trust with the audience while boosting search engine performance through increased engagement and traffic.

Engage With Followers to Increase Brand Visibility

LinkGraph’s innovative approach to SEO underscores the importance for loan officers to actively engage with their social media followers, thereby boosting brand visibility. By responding to comments, sparking discussions, and sharing insights, they create a dynamic online presence that attracts increased attention from both users and search engines alike.

As loan officers immerse themselves in the conversation with their online community, they not only foster brand loyalty but also signal to search algorithms the relevancy and authority of their content. This interaction plays a crucial role in cementing their status as industry thought leaders and enhancing their overall online visibility.

Integrate Social Media Activity With Overall SEO Strategy

Loan officers stand at the threshold of opportunity when they align their social media activity with their broader SEO campaigns, creating a harmonious digital marketing ecosystem. LinkGraph facilitates this integration, ensuring that every tweet, post, and share is amplified through strategic SEO to extend reach and consolidate online authority.

LinkGraph’s SEO services are uniquely positioned to synchronize the social signals with search engine algorithms, which in turn reinforces site visibility and strengthens domain authority. The dynamic relationship between social engagement and search metrics empowers loan officers to craft an online presence that reflects the acumen of their services and the relevance of their content.

Track Social Engagement Metrics to Refine Tactics

Loan officers meticulously deploy social media to enhance search engine optimization, yet without measuring the impact of their efforts, opportunities for refinement might be missed. Tracking social engagement metrics affords vital insights into user interactions, enabling loan officers to discern which types of content resonate most with their audience.

- Analysis of engagement rates uncovers high-performing content necessitating replication or expansion.

- Detailed views and clicks statistics inform the effectiveness of calls to action within shared materials.

- Monitoring changes in follower demographics guides content personalization to meet audience preferences.

This precision in analytics drives iterative enhancements to SEO tactics, ensuring that loan officers stay aligned with consumer behaviors. Rigorous engagement tracking empowers them with the data required to fine-tune their social media strategy to directly support their overarching SEO goals.

Mastering Mobile SEO for Loan Officers on the Go

As loan officers refine their digital footprint, the ascendance of mobile search use is reshaping the fundamentals of online engagement, rendering mobile SEO a critical facet of their marketing arsenal.

Mastery over mobile SEO lays the groundwork for not just visibility but also usability, optimizing interactions wherever the user may roam.

Responsive design ensures that websites elegantly adjust to tablets and smartphones, maintaining integrity and functionality.

Accelerating page load speeds mitigates bounce rates, holding the transient attention of mobile users.

Craft mobile-friendly content underscores the necessity for succinct, accessible information on smaller screens, enhancing readability and user experience.

For loan officers, tuning into the nuances of local search features on mobile platforms can solidify connections with the target audience, prompting immediate action and facilitating face-to-face customer interactions.

This strategic blend of techniques ushers in a revolutionized approach to search engine optimization, tailored for the loan officer ever on the move.

Ensure Responsive Design for Optimal Mobile Viewing

For a loan officer seeking prominence in the digital market, investing in responsive design is non-negotiable. LinkGraph’s approach ensures that a mortgage website adjusts seamlessly across various devices, delivering a uniform user experience that retains functionality and aesthetic appeal on any screen size.

By embracing web design that dynamically adapts to user behavior and environment, loan officers can ascertain that the crispness of their online offerings remains intact, regardless of how potential clients access their site. This pivotal aspect of mobile SEO solidifies user engagement and bolsters search rank, contributing significantly to a loan officer’s online success.

Accelerate Page Load Speeds With Mobile Optimization

In today’s fast-paced digital milieu, loan officers must ensure their websites are optimized for mobile devices, prioritizing page load speed as a critical factor. LinkGraph’s comprehensive SEO services rigorously optimize mobile web design, ensuring that loan officers’ websites load swiftly, providing immediate information access to users on the move.

This mobile optimization is pivotal as studies show a direct correlation between load speed and user retention: for every second delay in page load time, conversions can drop by up to 20%. The table below illustrates the urgent need for loan officers to employ mobile optimization techniques to maintain competitive edge:

| Mobile Optimization Factor | Importance |

|---|---|

| Minimized Javascript/CSS | Reduces latency and accelerates load times for mobile users. |

| Image Compression | Enhances page speed by reducing file sizes without compromising quality. |

| Optimized Web Hosting | Facilitates faster server response times for all user queries. |

Recognizing the significance of speedy, accessible content, LinkGraph empowers loan officers with site optimization techniques that enhance mobile user experience. This strategic focus on load speed optimization not only improves site rank but also boosts the likelihood of user engagement and conversion, essential to the success of a modern loan officer’s digital presence.

Craft Mobile-Friendly Content for Better User Experience

In the quest for digital preeminence, loan officers must tailor their content for mobile consumption, where concise, clear, and approachable language takes precedence. LinkGraph’s expertise in SEO services steers professionals to devise content that not only reads comfortably on smaller screens but also incorporates mobile-centric SEO techniques to improve search visibility and user engagement.

Driving the user experience forward entails the strategic presentation of information that mobile users can swiftly navigate and comprehend. Loan officers, with guidance from LinkGraph, craft content that resonates on a mobile level, ensuring that the most pertinent points are accessible with minimal scrolling and zooming, thus solidifying the impact of their online presence.

Optimize Local Search Features for Mobile Users

For loan officers aiming to enhance their mobile presence, optimizing for local search features is critical. By integrating mobile-specific local SEO tactics, these professionals can ensure their services are readily discoverable to users performing searches ‘on the go’ within their immediate locality.

As mobile users often seek quick, location-based information, having a loan officer’s contact details and location easily accessible forms a direct link to the consumer, prompting expedited engagement and driving up local search visibility:

| Local Search Feature | Optimization Technique | Benefit for Loan Officers |

|---|---|---|

| Click-to-Call | Ensure phone numbers are clickable and prompt immediate calls on mobile devices. | Facilitates instant communication, addressing user needs swiftly. |

| Maps and Directories | Accurate, updated listings on map services and local directories. | Improves the chances of being found by nearby prospective clients. |

| Mobile Customer Reviews | Display prominent reviews and ratings viewable on the mobile interface. | Enhances credibility and trust for users considering local services. |

Seamlessly integrating with mobile user behaviors, loan officers can leverage features such as GPS-enabled directions and locality-focused content. This strategic optimization connects users directly to the mortgage expert’s virtual doorstep, offering a seamless transition from online search to physical engagement.

Implementing Technical SEO to Improve Website Performance

The digital arena wherein loan officers vie for the attention of discerning searchers is governed by a multitude of factors, with technical SEO standing as the backbone of a well-optimized website.

In this quest for dominion over online search results, the implementation of strategic technical enhancements can be the fulcrum upon which ranking success pivots.

The path to achieving and sustaining a commanding online presence involves accelerating site speed through advanced caching techniques, structuring data for optimal interpretation by search engines, regularly auditing the site to adres technical inefficiencies, and solidifying user trust with a secure HTTPS protocol.

Each of these components plays a critical role in crafting a robust foundation for a loan officer’s search engine optimization strategy, enabling their digital platform to perform at peak efficiency in the competitive search landscape.

Improve Site Speed With Advanced Caching Techniques

Loading times are pivotal in retaining visitor interest and optimizing for search engines. Loan officers, guided by LinkGraph’s expert SEO services, are enhancing their websites’ performance with advanced caching techniques, which allow repeated visitors to experience faster page loading by storing static parts of the site locally on their first visit.

By implementing such caching methods, mortgage professionals ensure their content is accessed efficiently, improving overall user experience and contributing to better SEO rankings. This focus on swiftness ensures that their website maintains a competitive edge, essential for capturing the attention of potential mortgage applicants in a fast-paced digital age.

Structure Data for Enhanced Search Engine Understanding

In the intricate world of search engine algorithms, loan officers have found a strategic ally in structured data to convey their message with clarity. LinkGraph’s advanced SEO tactics involve meticulous labeling of website elements—ranging from customer reviews to local business information—which empowers search engines to process and present content in feature-rich snippets.

By embedding this enhanced data into their digital frameworks, loan officers are not merely cataloging information; they are crafting a narrative that search engines can readily interpret. This intelligent structuring elevates the precision of search results, rendering the loan officer’s offerings more visible and attractive to potential clients navigating the mortgage landscape.

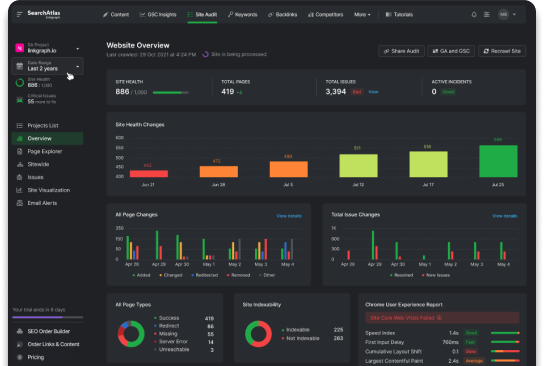

Conduct Regular Site Audits to Identify Technical Issues

LinkGraph’s diligent provision of SEO services encompasses the crucial practice of conducting regular site audits for loan officers. These audits unearth technical issues that may impede a website’s performance and obstruct its trajectory towards the apex of search engine results.

- A detailed examination detects site errors, broken links, and loading hiccups, enabling swift rectification.

- Analysis of mobile responsiveness ensures that a site meets the rigorous standards of modern user behavior.

- Inspection of security features upholds site integrity, fortifying against vulnerabilities that could deter visitors and search crawlers alike.

Loan officers, through the expertise offered by LinkGraph, recognize that staying ahead in the digital space involves a constant review and refinement. These comprehensive site audits stand as a testament to an unwavering commitment to excellence, safeguarding the seamless functionality that both users and search engines demand.

Secure Your Site With HTTPS to Gain Trust From Search Engines

To rise above the digital competition, loan officers must secure their sites with HTTPS—an essential trust signal for search engines and users alike. Integrating HTTPS not only encrypts data exchange between the server and consumer, but it also denotes a level of security that search algorithms favor when ranking websites.

This adoption of HTTPS manifests as a badge of authenticity and establishes a haven of security, encouraging user confidence and interaction. The positive association forged by this secure protocol contributes significantly to a site’s credibility and search engine trust:

- HTTPS serves as a mark of a secure and privacy-conscious website.

- Loan officers can leverage this security measure to boost consumer trust and search engine sentiment.

- With HTTPS, the integrity of user data is maintained, enhancing the overall value proposition of the website.

Frequently Asked Questions

How can loan officers enhance their website’s authority through quality backlinks?

Loan officers can bolster their website’s authority by engaging in white label link building, as such strategies focus on acquiring quality backlinks from reputable sources within the mortgage industry. Furthermore, a comprehensive backlink analysis, when delivered by LinkGraph’s seasoned experts, can identify opportunities for strengthening a site’s link profile to improve search rank and credibility among search engines and users alike.

What are the advanced strategies for keyword research that loan officers can use to improve their SEO?

Loan officers aiming to enhance their SEO can turn to advanced tactics such as utilizing Search Atlas’s keyword research tool, which enables the identification of long-tail keywords that align with user intent and refinements of targeting strategies to match consumer behavior. Additionally, a thorough SEO audit provided by LinkGraph can reveal opportunities for optimizing web content and meta tags, ensuring that loan officers achieve a competitive edge in the ever-evolving mortgage marketplace.

How can loan officers optimize their online listings for local SEO success?

Loan officers can significantly enhance their online presence and captivate prospective borrowers by leveraging Local SEO tactics, which include meticulously optimizing their Google Business profile, incorporating relevant mortgage keywords, and utilizing backlink strategies to improve their local search result rankings. Adopting these techniques positions a loan officer’s services directly in the path of local searchers, increasing the likelihood of generating qualified leads in the mortgage industry.

What steps should loan officers take to craft a content marketing strategy that boosts their SEO efforts?

Loan officers should begin by conducting thorough keyword research tailored to the mortgage industry, ensuring they target terms and phrases that resonate with the specific concerns and queries of homebuyers and mortgage applicants. Subsequently, they must integrate these target keywords into a comprehensive content strategy that includes high-quality blog writing, guest posting, and a robust web design, all aimed at enhancing user experience and search engine rankings, while continually measuring and refining their approach based on detailed backlink analysis and SEO audits provided by experts such as LinkGraph.

How can loan officers leverage social media platforms to amplify their SEO and reach a wider audience?

Loan officers can harness the power of social media platforms by crafting a content strategy that aligns with their SEO goals, ensuring visibility among potential home buyers and enhancing engagement. Through consistent posting of relevant, keyword-optimized content and active interaction with users, they strengthen their online presence and drive traffic to their mortgage-focused web pages, thereby expanding their reach and influence among target audiences seeking home loans.

Conclusion

In conclusion, loan officers who master advanced SEO strategies significantly enhance their online search visibility and authoritative standing.

By acquiring quality backlinks from high-authority domains, crafting compelling content, engaging with industry influencers, leveraging partnerships for link sharing, and meticulously monitoring for toxic backlinks, they position their sites favorably in search engine rankings.

By also conducting expert keyword research, optimizing for local SEO, creating engaging visual and written content, and utilizing social media to amplify SEO efforts, loan officers can attract and retain a targeted audience.

Additionally, prioritizing mobile SEO and implementing technical SEO adjustments, such as improving site speed, structuring data correctly, conducting regular site audits, and securing sites with HTTPS, are essential for building a trustworthy and responsive online experience.

Altogether, these strategies form a powerful SEO framework that enables loan officers to outperform competitors and effectively connect with prospective clients in the digital mortgage marketplace.